6TH EDITION

STATE OF THE COCOA SECTOR

THE COCOA SECTOR IS EXPERIENCING CHAOS

Global Prices of Cocoa

The price of cocoa, skyrocketed from USD 2,000−3,000 per ton in 2023 to over USD 12,000 per ton in 2025.

This wasn’t just a spike – it was a seismic shift, and the market shows no signs of stabilizing. Prices are expected to fluctuate for years to come. Along with other factors, this causes great uncertainty.

Why Are Prices Spiking?

The reasons are as heartbreaking as they are complex

Climate Change

Climate change is ravaging cocoa farms. Unpredictable weather extremes bring new challenges. Heatwaves and intense rains are upending harvests.

Illegal Mining

Illegal mining is destroying farmland in West Africa. Cocoa trees are being destroyed in the search for gold, leaving farmers destitute.

Pest and Disease

Pests and diseases are decimating crops. Along with this, aging cocoa trees are less productive. Farmers are watching their livelihoods vanish.

The result? Less cocoa. Higher prices.

The Heart of the Crisis: West Africa

Côte d’Ivoire and Ghana, the world’s largest cocoa producers, are bearing the brunt. Production in Côte d’Ivoire dropped by 22%, and in Ghana by 31%, from 2022/23 to 2023/24. Meanwhile, the rest of the world saw only a 1% decline.

Production

Côte d’Ivoire

2023

22%

2024

Ghana

2023

31%

2024

Rest of the world

2023

1%

2024

OVER

1 MILLION

TONNES OF COCOA

FROM DEFORESTED

OR UNKNOWN SOURCES

The European Union Regulation on Deforestation-free Products (EUDR) adds another layer of complexity.

For compliance with the EUDR, cocoa needs to be traceable, geolocation mapped and confirmed deforestation-free.

For companies in the Chocolate Scorecard:

62% of cocoa is traceable to the farmer group.

55% is covered by a deforestation monitoring system.

54% is confirmed deforestation free.

Compliance should not be an issue if companies continue to invest in traceable, deforestation-free supply chains. Traceability and monitoring are possible.

Companies often have clear processes for cutting off non-compliant farmers from their supply chains. Only a few companies help and support non-compliant farmers. Companies must support all farmers, not just compliant farmers.

Chocolate’s New Reality: Shrinking Bars, Rising Prices

The ripple effect is hitting consumers hard

In the UK for example:

price

x2

A Ferrero Rocher Easter Egg now costs more than double what it did in 2023.

increase

£3

A 1kg bag of Cadbury Easter eggs (made by Mondelēz) has increased by £3 every year since 2023.

100 to 90 grams

-10%

And it’s not just prices – products are shrinking too. Mondelēz reduced its Milka bars from 100 grams to 90 grams while raising the price.

Are Companies Struggling?

Not Exactly.

Nestlé

$11.3B

in net profit

Nestlé made CHF 10 billion (approximately USD 11.3 billion) in net profit in 2024.

Mondelez

$4.5B

in net profit

Mondelēz reported USD 4.5 billion in net earnings.

Retailers

$1.5T

in revenue

The world’s top retailers – Walmart, Costco, Lidl, Aldi, and others – generated a combined revenue of USD 1.5 trillion.

While farmers and consumers struggle, chocolate companies continue to make good profits.

Why Are Companies Profiting?

Long Supply Chains

It can take years for cocoa to reach the final product. Companies are charging higher prices for cocoa they might of bought cheaply months or even years ago.

Cocoa is Only Part of Chocolate

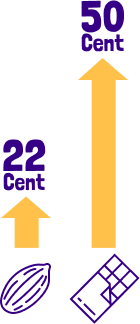

Cocoa makes up a smaller part of the price than companies claim. For example, a 100-gram Milka bar contains 30 grams of cocoa. The cost of that cocoa increased by 22 cents, but the bar’s retail price rose by 50 cents.

Negligible Compliance Costs

The cost of complying with the EUDR will only be 0.1% of annual revenue. The Corporate Sustainability Due Diligence Directive (CSDDD) will cost only 0.13% of annual shareholder payouts.

Passing on the Costs

Chocolate companies are simply passing the higher costs (and more) on to their customers or to the end-consumer to grow their profits.

Retailers: Same Responsibility

Suppliers

100

suppliers providing cocoa-based products

Retailers sell their own private-label chocolate—brands they own—on the same store shelves as the chocolate company brands. They share the same responsibility for ensuring sustainability in their private-label products as chocolate companies. We acknowledge that the large number of suppliers retailers work with makes this responsibility more complex. While chocolate companies typically deal with 10-20 suppliers, retailers may have hundreds of suppliers providing cocoa-based products.

Many retailers rely on certifications like Rainforest Alliance or Fairtrade, but research shows these programs alone aren’t enough. Some, like AholdDelhaize, Aldi, Colruyt and Waitrose, are adopting initiatives like Tony’s Open Chain.

Cocoa Production Areas