INSIGHTS

EXPLORE THE CHOCOLATE SCORECARD

Traceability and Transparency

Traceability has increased significantly but much work remains for EUDR compliance

The upcoming EU Deforestation Regulation (EUDR) is having tremendous impact on the cocoa sector.

commitment

traceable cocoa volumes

For many companies we see the impact of EUDR in their traceability commitments. 89% have a traceability commitment. For most commitments, the target date is in 2024 or 2025, coinciding with the start of the EUDR.

As a result, we have seen a large spike in traceable cocoa volumes this year. Traceability to country of origin has increased by 27%, to farmer group or community level by 19%, and to farm level by 19%.

Companies also appear to be making great progress in mapping of farms

Companies claim to already have 64% of their supply chain GPS or polygon mapped, compared to 55% of cocoa supply that needs to be EUDR compliant.

However, large gaps still remain

Of the big companies that reported data, only 41% can currently trace enough cocoa back to the farmer group for EUDR compliance. 59% of the big companies are still short of EUDR compliance on traceability. For this group, this amounts to a gap of almost 700,000 tons of cocoa beans.

700.000 T

OF COCOA NOT COMPLIANT WITH EUDR

We are not seeing an improvement in direct cocoa sourcing. An average of 50% of big company supply was direct, same as last year.

The cocoa sector will be very busy this year achieving EUDR compliance. As companies continue to increase traceability, mapping and monitoring of supply chains, we hope to also see the industry support the producing countries in their achieving compliance and protecting forests.

Living Income

Chocolate is big money, but too many farmers are still living in poverty

Chocolate is a multi-billion dollar industry, with some of the wealthiest and most powerful companies in the world profiting from it. However, many cocoa farmers, who produce the essential ingredient of the industry, still live in poverty and struggle to earn a living income. In other words, they can't achieve a decent standard of living.

company claims

companies claim they are paying 100% of the farmers in their supply chain enough for a decent living

Farmers deserve a decent living. No farmer should be forced to choose between sending their children to school and sending them to work so they can have enough money to eat.

LIVING INCOME IS

Living Income is the net annual income required for a household in a particular place to afford a decent standard of living for all members of that household. Elements of a decent standard of living include food, water, housing, education, health care, transport, clothing, and other essential needs including provision for unexpected events (Living Income Community of Practice 2020)

Child Labor

Efforts to reduce child labor are increasing.

Child labor practices are improving, which is encouraging after 23 years of concerted efforts! Despite the complexity and challenges involved, there has been a noticeable increase in efforts to address this issue. Policies are in place in most companies, and through the work of groups like the International Cocoa Initiative (ICI) and initiatives like Child Labor Monitoring and Remediation Systems (CLMRS) and others, these are beginning to yield positive results.

However, there is still a way to go to its elimination

The root causes are widely recognised – the dominant but not exclusive one being poverty. Systemic approaches are contributing to increased quality education, health care, sector jobs for young adults and gender support for girls / women - but not across the whole sector.

- 68%

of larger chocolate companies say they have evidence that the programs or schemes are reducing the prevalence of child labor situations – but verification is vague from many companies. - 100%

of respondents have a policy for monitoring, reducing, or eliminating child labor in the company’s supply chains but the average of farmer households in the supply chain covered by the programs is 55% and it is not clear if this is only with the direct supply chain. - 18%

of company respondents say they had found and successfully remediated cases of forced labor and human trafficking in the past 12 months. In the 4th Edition of the Chocolate Scorecard only one company identified cases. This increase shows great leadership in appropriate actions and transparency by these companies. They are to be commended. - 83%

of respondents reported having a policy to monitor, reduce or eliminate the exposure of children to pesticides and 70% say they are taking gender into account.

Deforestation and Climate

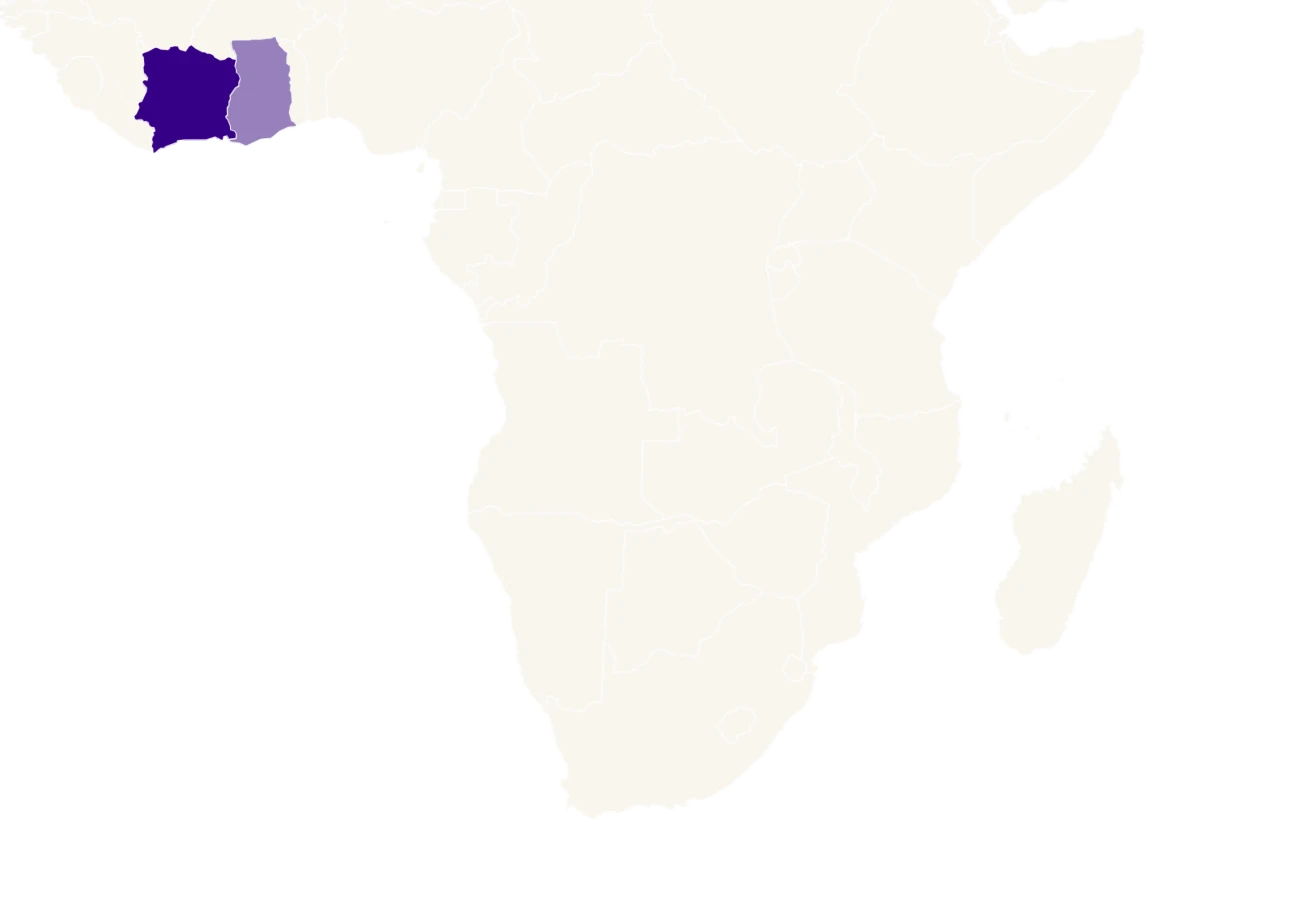

West Africa produces 70% of the world’s cocoa, mostly in Côte d’Ivoire and Ghana. In the last 60 years, these two African countries have lost around 94% and 80% of their forests, one-third was cleared for growing cocoa. Many of the remaining global tropical forests provide critical habitat to endangered species, including great apes.

There are initiatives to stop deforestation for cocoa. Companies and governments have committed to ending cocoa-driven deforestation through the Cocoa & Forests Initiative (CFI). European Union Deforestation Regulation (EUDR) comes into force in December 2024, putting an obligation on companies to end all deforestation in their supply chains. However, neither of these initiatives have global coverage and therefore leave large forests unprotected.

We also see this in our data, 37% of the cocoa volume of respondents is not covered by a deforestation-free monitoring system. This is a slight increase of 3% from the 4th Edition. We also see that 36% of cocoa production is not yet mapped. 46% of their cocoa doesn’t need to be EUDR compliant. We postulate that companies are focusing on what is needed for compliance.

We see another troubling development. The EUDR doesn’t allow deforestation after 2020. Last year, 49% of respondents were only using cut-off dates for deforestation before 2020, many as early as 2014. This percentage dropped to only 27% this year. Many respondents are now using 2020 as the cut-off date. As one respondent said: globally we apply a 2017 cut-off date, but practically we may have to apply 2020 (EUDR) in the future.

comparison of cut-off dates

4th

Edition

5th

Edition

- 2019 or earlier

- 2020

- Both 2020 and earlier

- No answer

Agroforestry

The industry still struggles to have a clear agroforestry definition. This is limiting its impact

commitment

47%

of big companies

31%

of retailers

sourcing

financial

The largest companies are still committed to sustainability programs in which agroforestry plays an important role. 47% of the big companies and 31% of the retailers have their own policy or approach to agroforestry.

However, companies struggle to have a clear agroforestry definition. For example, the number of trees species required varied from 3 to over 26 species per hectare. As a result, the claims varied wildly. One large company claimed to source 100% agroforestry, while another large company was at 0%. Even with these wide-ranging definitions, 44% of companies are still not sourcing any cocoa grown in an agroforestry setting.

We don’t have a clear indication of the impact on cocoa growing landscapes. Agroforestry promotion is costly but few companies are monitoring the success of their plantation program, or share data from this monitoring.

43% of companies and retailers are providing no financial or in-kind agroforestry support at all.

Compared to last year, we do see positive developments in the Dynamic Agroforestry (DAF) approach. It was most present in actions by (HALBA). We can see that it is also being adopted by other companies, including some of the larger ones.

Pesticides

The chocolate industry is failing to protect people and the environment from the dangers of highly hazardous pesticides

Every year, an estimated 44% of all farmers and farmworkers suffer acute poisoning by pesticides, that’s 350 million people. Cocoa is no exception. Cocoa farmers and children are also exposed to these hazardous chemicals.

every year

- 7

companies (all of which are small companies) are 100% certified organic and must adhere to stringent practices which exclude chemicals - Only 1

company (HALBA) which is not 100% organic has put in place sufficiently strong pesticide policy, strategy, and program. They have targets to exclude certain pesticides and build dynamic agroforestry setting for cocoa production

Disturbingly, children’s exposure to pesticides in cocoa is rising. The number of child laborers exposed to harmful pesticides increased from 10% in 2014 to 27% in 2019, along with an increase in injuries, health impacts, and level of care needed.

child exposure

- 14

companies have no policy or did not answer the question - 41

companies claim to have a pesticide policy for the cocoa they source. More than half are building on third-party schemes such as Rainforest Alliance and Fairtrade

Gender and 100% Sustainable

Gender equality is essential for a more sustainable cocoa sector

The cocoa industry is known for making bold sustainability claims. At least 65% of the companies and retailers are making a 'sustainability' claim. Many of these are at odds with the definition of sustainability used by the Chocolate Scorecard from the Bründtland Commission “meeting the needs of the present without compromising the ability of future generations to meet their own needs.”

While some of these companies are now moving away from bold claims, many companies are still claiming to source “100% sustainable” cocoa. But how sustainable is this cocoa when there are still so many issues? Children are still working on farms, forests are still being cut, and farmers are still not earning a living income.

Gender inequality is a global issue.

The World Bank reports that there is no equality for working women in any country in the world. We also see this in cocoa production, where female cocoa farmers often have lower incomes, own less land, and lack decision-making power. All while carrying out most of the labor.

One of the underlying issues that we looked at more closely this year is gender equality. We added this not only because of the many gender-related issues in cocoa production, but also because addressing these issues is a crucial part of the solution.

While we saw some fantastic initiatives addressing gender issues, none of the companies and retailers received full points on gender. The highest score for big companies was 77%, for small companies 76%, and for retailers 82%. Only 27% received full marks for having a gender strategy for cocoa.

Addressing gender issues in cocoa has many benefits. Most importantly, it benefits women in cocoa growing communities and gives them more opportunities. Women’s empowerment has been shown to lead to reductions in child labor, increases in school attendance and improvements for the community as a whole. We ask the entire industry to follow the lead of the winner of the Chocolate Scorecard gender award, Pladis.